If you already have an LLC in another state and want a Colorado LLC, then how to start an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Colorado.

On this page, you’ll learn about the following:

Forming an Colorado Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Colorado, you need to register it with the Colorado Secretary of State.

Step 1: Choose Colorado Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Colorado Secretary of State. Your LLC’s legal name outside of Colorado will be listed on the application, along with the name it will use in Colorado. Take note of the requirements for naming your LLC.

Check name availability at Colorado’s business entity names and reserve your LLC name.

Step 2: Select Colorado Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Colorado and take note that a Colorado registered agent must have a local address. Here are three of the best LLC services on our list:

Step 3: File Registration of Colorado Foreign LLC

Fill out and submit a Statement of Foreign Entity Authority via email to [email protected] or by mail to Colorado Department of State, 1700 Broadway Suite 550 Denver, CO 80290.

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Colorado

- Date when your LLC will start operations in Colorado.

- Credit card information on the last page of the form for the $100 application fee.

The LLC cost in Colorado, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Colorado Foreign LLC is taxed

Foreign LLCs are also subjected to the Colorado Business Privilege Tax, and they must file LLC annual reports each year.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Filing Colorado Foreign LLC Online

Time needed: 5 minutes

When you start a foreign LLC registered in Colorado, you need to pay $100 as filing fees. For the online filing process, one has to follow the online filing guidelines. Here’s what you need to do.

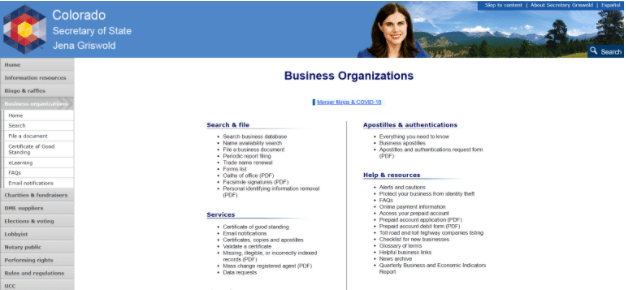

- Go to the Official Website

To start the process, visit the Colorado Secretary of State portal. Select the ‘File a Business Document’ from the list given and go to the business document page.

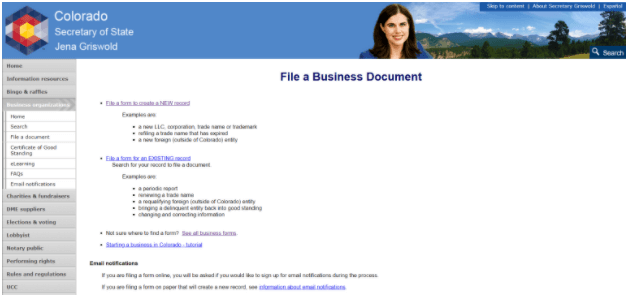

- Create a New Record

To start registering your Colorado foreign LLC, click on the ‘File a form to create a NEW record’ option on your screen.

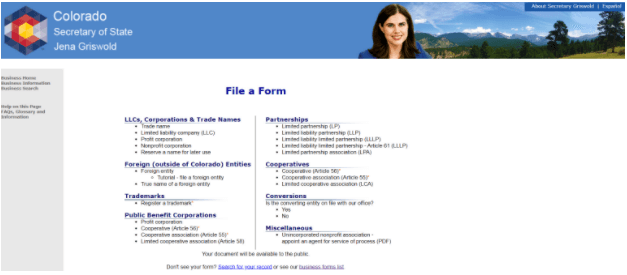

- File a Form

In this section, you will get a list of business types to form. Select “foreign entity” as you are intended to register an out-of-state entity in Colorado.

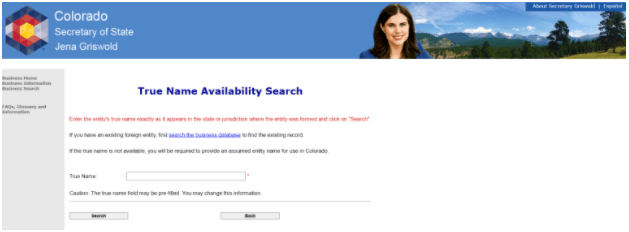

- True Name Availability Search

In this section, you need to enter the exact same name of your LLC. In the case of a foreign LLC in Colorado, you have to mention the exact same name of your LLC that is already formed in other states.

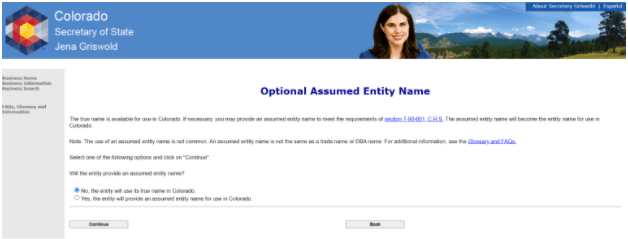

- Optional Assumed Entity Name

If you wish to give your foreign LLC in Colorado a new name, then you can select this option. On the other hand, if you want to stick to the exact name of your LLC then select the option “no” and move on to the next section.

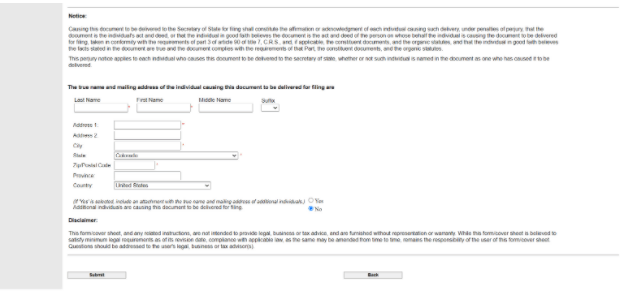

- Statement of Foreign Entity Authority

This is the main section of the registration process. You will get the form/statement to fill. Enter all the relevant information related to your LLC and click on the “Submit” button. The following sections are to be filled out:

> Form details

> Principal Address

> Registered Agent information

> Additional Information

> Delayed Date

> Email Address

> Details of the individual who is filing the document

After entering all the information, hit the “Submit” button to go to the payment page - Payment

Finally, make the payment of $100 to complete the online registration process for the Foreign LLC in Colorado.

It is convenient plus easy to file for the foreign LLC if you are doing it online. The steps are very easy and that’s why it’s possible to go along with the steps and form the foreign LLC in Colorado.

After Forming Colorado Foreign LLC

Here are added things you need to accomplish after forming your Colorado Foreign LLC

- Obtain Business Licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

F.A.Qs

If your LLC is formed under the laws of another state, it is referred to as a foreign LLC in Colorado.

Businesses incorporated outside of the state where they operate must have “foreign qualifications” issued in the other states.

A domestic LLC is a company registered in Colorado as an LLC. The entity type that has a physical presence in another state is a foreign LLC.

How Much Does It Cost to Register a Foreign LLC in Colorado

To register as a foreign LLC in Colorado, you can file it online by paying $100 to the Colorado Secretary of State

One of the primary costs associated with registering a foreign LLC in Colorado is the filing fee required by the Colorado Secretary of State’s office. This fee typically covers the cost of processing and reviewing the necessary paperwork to officially register the foreign LLC in the state. Foreign businesses should be prepared to budget for this fee as part of their overall startup costs when expanding into the Colorado market.

In addition to the filing fee, foreign LLCs may also need to consider other costs such as hiring a registered agent in Colorado. A registered agent is a required entity for any business operating in the state and serves as an official point of contact for legal correspondence. While some foreign LLCs may choose to appoint an existing member of their organization as the registered agent, others may opt to hire a third-party registered agent service. The cost of hiring a registered agent should be factored into the overall budget for establishing a foreign LLC in Colorado.

Foreign businesses should also be aware of ongoing costs associated with maintaining their LLC status in Colorado. This may include annual report filings, franchise taxes, and other compliance requirements imposed by the state. It is important for foreign LLCs to stay up to date on these requirements to avoid potential penalties or fines for non-compliance.

While the costs of registering a foreign LLC in Colorado may seem daunting, it is important for foreign businesses to weigh these expenses against the potential benefits of establishing a presence in the state. Colorado boasts a diverse economy and a business-friendly environment, making it an attractive destination for foreign businesses looking to expand their operations in the United States.

Ultimately, the decision to register a foreign LLC in Colorado should be carefully considered and planned for. By understanding the costs associated with registration and compliance, foreign businesses can make informed decisions about their expansion into the Colorado market. With the right preparation and budgeting, foreign LLCs can successfully navigate the registration process and establish a foothold in the thriving business landscape of Colorado.

In Conclusion

Starting a foreign LLC in Colorado does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.