If you already have an LLC in another state and want a Utah LLC, then starting an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Utah.

On this page, you’ll learn about the following:

Forming an Utah Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Utah, you need to register it with the Utah Secretary of State.

Step 1: Choose Utah Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Utah Secretary of State. Your LLC’s legal name outside of Utah will be listed on the application, along with the name it will use in Utah. Take note of the requirements for naming your LLC.

Check name availability at Utah’s business entity names and reserve your LLC name.

Step 2: Select Utah Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Utah and take note that a Utah registered agent must have a local address. Here are three of the best LLC services on our list that will provide you with registered agents to ease your worries:

Step 3: File Registration of Utah Foreign LLC

Fill out and submit a Foreign LLC Application for Registration form via email to [email protected] or by mail to Utah Secretary of State Business Services, P.O. Box Utah Division of Corporations & Commercial Code P.O. Box 146705 Salt Lake City, UT 84114

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Utah

- Date when your LLC will start operations in Utah.

- Credit card information on the last page of the form for the $150 application fee.

The LLC cost in Utah, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Utah Foreign LLC is taxed

Foreign LLCs are also subjected to the Utah Business Privilege Tax, and they must file LLC annual reports each year.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Filing Utah Foreign LLC Online

Time needed: 5 minutes

To initiate your foreign business LLC operations in the State of Utah, as a preliminary step, you are required to apply for a Certificate of Authority from the Secretary of State office. The cost of registration is $70 (non-refundable). After approval, you will receive a certified copy of your foreign business registration. We have explained the aspects you need to cover while applying for foreign business registration in Utah.

Following are the steps to register a Foreign LLC online:

- Go to the official website of the Secretary of State of Utah

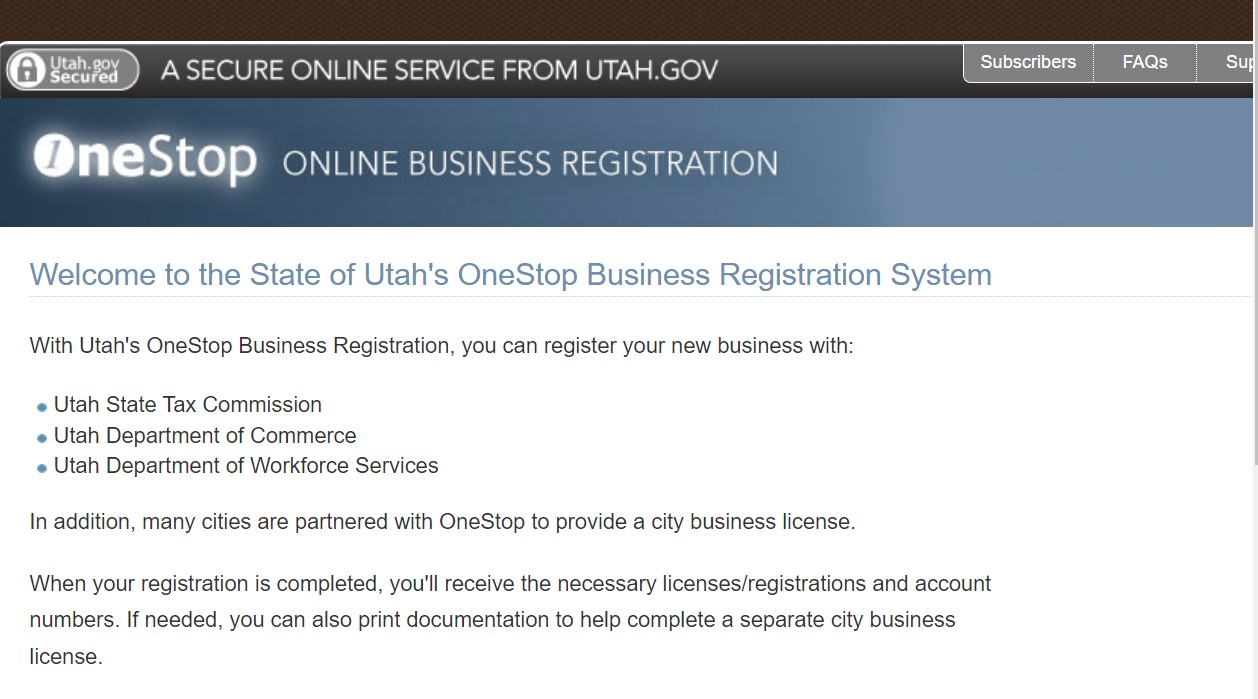

Visit the official website of the Utah Secretary of State. The website hosts a One-Stop Portal for Online business registration and filings. On the webpage, scroll down and click on the ‘Continue’ tab.

- Create a business account on the portal

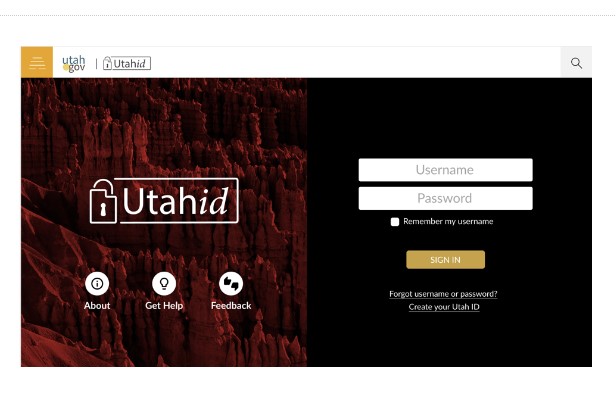

On the following page, the login box appears. In case you already have an account, enter your username and password and sign in to access your personal account on the portal. In case you do not have an account, click on the ‘Create your Utah ID’ link. On the next page, provide your personal information and create your user ID and password. Click on the ‘Submit’ tab.

- Start to file your online application

Login to your Utah business portal account using your user ID and password. On the user landing page, select the option to “Register a New Business”. Next, click on “Begin Registration”. Select the business type as a foreign business in Utah and proceed to answer the questions as per your business filing. Now, click on the ‘Next Step’ option. Answer the questions put forward on the next page. These pre-registration questions. Next, choose your business entity type from the drop-down menu and now you can proceed to start your application.

- Read the guidelines

Read all the instructions and guidelines attached to the online application. Start to fill in all the required details in the application form. Do not skip any mandatory section.

- Recheck your application

Revisit all the sections to ensure that all the information provided by you is true and correct to your knowledge. Your application shall be rejected in case of any error or non-compliance.

- Make the payment

After finalizing the application, you can proceed to the payment gateway page and pay $70 as the filing fee for your online application. On successfully completing your application, you will receive a notification from the Secretary of State office, acknowledging the receipt of your application.

Steps to Filing Utah Foreign LLC by Mail

You can also file your foreign business registration application by mail.

- Download the application form PDF on your device.

- Read all the instructions attached to the application form and accordingly fill in all the required details.

- Attach the certificate of Good standing issued by the State of Original jurisdiction.

- Issue a money order or check for $70 as the filing fee payable to the State of Utah.

- Arrange all the documents together and mail it to the following address, Utah Division of Corporations & Commercial Code, P.O. Box 146705, Salt Lake City, UT 84114.

After Forming Utah Foreign LLC

Here are added things you need to accomplish after forming your Utah Foreign LLC

- Obtain Business Licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

How Much Does It Cost to Register a Foreign LLC in Utah

To register as a foreign LLC in Utah, you can file through mail or online by paying a filing fee of $70 to the Utah Division of Corporations & Commercial.

One of the key costs to consider when registering a foreign LLC in Utah is the initial filing fee. This fee is paid to the Utah Division of Corporations and amounts to a set dollar figure. The exact amount of this fee can vary depending on a variety of factors, including the type of entity being registered and the specific services required. It is important for businesses to research and understand these costs beforehand to avoid any surprises or unexpected expenses.

In addition to the initial filing fee, businesses should also consider ongoing costs associated with maintaining a foreign LLC in Utah. These may include annual reports and fees, renewal fees, and any additional compliance requirements imposed by the state. These costs can add up over time and should be factored into a business’s budgeting and financial planning processes.

It is also important for businesses to be aware of any other potential costs that may arise during the registration process. This may include additional fees for expedited processing, name reservation, or any legal or professional services required to complete the registration. By understanding all potential costs upfront, businesses can better prepare themselves and make informed decisions about whether registering a foreign LLC in Utah is the right choice for them.

Despite the various costs associated with registering a foreign LLC in Utah, businesses should not let financial considerations deter them from pursuing opportunities in the state. Utah is known for its business-friendly environment, strong economy, and supportive regulatory framework. By taking the time to understand and plan for the costs involved, businesses can position themselves for success and growth in the state.

In conclusion, the costs of registering a foreign LLC in Utah should not be taken lightly. Understanding the financial implications of this process is essential for businesses to make informed decisions and plan accordingly. By researching and budgeting for these costs upfront, businesses can navigate the registration process with greater ease and confidence. Ultimately, the investment in registering a foreign LLC in Utah can open the door to new opportunities and growth for businesses looking to expand their operations in the state.

In Conclusion

Starting a foreign LLC in Utah does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.